India’s Tourism and Hospitality Sector

By Suman Tarafdar

Delhi, India

October 2020

With India’s peak tourist season taking off under unprecedented circumstances this year, here is a look at the impact and the steps the tourism and hospitality sectors are taking to revive confidence and salvage the season.

“April and May 2020 witnessed NIL occupancy and revenue at all the Neemrana properties across India.” Details apart, this sentiment of the generally affable Aman Nath, Founder and Chairman of Neemrana Hotels, has been echoed by many in the India’s usually bustling tourism sector.

“April and May 2020 witnessed NIL occupancy and revenue at all the Neemrana properties across India.” Details apart, this sentiment of the generally affable Aman Nath, Founder and Chairman of Neemrana Hotels, has been echoed by many in the India’s usually bustling tourism sector.

“We will have no guests till next year,” read an update from a boutique hotel owner who depends largely on inbound tourists. “We expect a 90 percent decline in business, we need aid to survive,” said another, whose adventure tourism company came to grinding halt and is unlikely to revive any time soon.

Such tales of hardship and woe have been echoing from all segments of tourism and hospitality sectors since India’s novel coronavirus lockdown began on March 25. The ‘big fat Indian wedding’ is looking to be on an unprecedented diet this season. Business hotels are repositioning to allure the domestic leisure traveller. Mass tourism destinations remain deserted. OTAs are struggling with cash flows. Small operators fear for their survival, as does the civil aviation sector. Convention hotel owners stare bleakly into the future. Yes, for most Indians, travel and holidays are now a luxury. Indeed, as Manvendra Singh Shekhawat, Managing Director, MRS Hotels puts it, “the biggest challenge that we and the sector as a whole had to deal with is the on-going uncertainty and to understand how to reinstate a person’s confidence in travel.”

Such tales of hardship and woe have been echoing from all segments of tourism and hospitality sectors since India’s novel coronavirus lockdown began on March 25. The ‘big fat Indian wedding’ is looking to be on an unprecedented diet this season. Business hotels are repositioning to allure the domestic leisure traveller. Mass tourism destinations remain deserted. OTAs are struggling with cash flows. Small operators fear for their survival, as does the civil aviation sector. Convention hotel owners stare bleakly into the future. Yes, for most Indians, travel and holidays are now a luxury. Indeed, as Manvendra Singh Shekhawat, Managing Director, MRS Hotels puts it, “the biggest challenge that we and the sector as a whole had to deal with is the on-going uncertainty and to understand how to reinstate a person’s confidence in travel.”

The immediate big question for most tourism and hospitality operators in the country is how  they will tackle at the upcoming October to March season – traditionally their ‘peak’ season. With record contractions in economies – at global, national and personal levels, coping and surviving in 2020 is a task in itself. The Federation of Associations in Indian Tourism & Hospitality (FAITH) – has said that as a result of this pandemic, the tourism industry in India is in dire straits. In a letter to Prime Minister Narendra Modi earlier this year, Nakul Anand, FAITH President and Executive Director, ITC Limited wrote, “Indian tourism industry is looking at pan-India bankruptcies, closure of businesses and mass unemployment. It is believed that around 70 percent or 3.8 crore people out of the estimated direct and indirect workforce of 5.5 crores could get unemployed.”

they will tackle at the upcoming October to March season – traditionally their ‘peak’ season. With record contractions in economies – at global, national and personal levels, coping and surviving in 2020 is a task in itself. The Federation of Associations in Indian Tourism & Hospitality (FAITH) – has said that as a result of this pandemic, the tourism industry in India is in dire straits. In a letter to Prime Minister Narendra Modi earlier this year, Nakul Anand, FAITH President and Executive Director, ITC Limited wrote, “Indian tourism industry is looking at pan-India bankruptcies, closure of businesses and mass unemployment. It is believed that around 70 percent or 3.8 crore people out of the estimated direct and indirect workforce of 5.5 crores could get unemployed.”

Meanwhile the Hotel Association of India (HAI) has sought relief measures on an urgent basis, saying HAI expects the government of India, state governments and municipal bodies across the country to defer all statutory liabilities, including EMIs for at least the next 12 months.

The Union Minister of Culture and Minister of Tourism of India, Prahlad Singh Patel said in an interview that the only way to make India an attractive destination is to focus on hygiene, safety, security. “Domestic travel will resume in a phased manner. The hotel and travel industry in India is very mature. It will come up with innovative offerings. From our side we will focus our promotions and campaigns to push those offerings.”

The Union Minister of Culture and Minister of Tourism of India, Prahlad Singh Patel said in an interview that the only way to make India an attractive destination is to focus on hygiene, safety, security. “Domestic travel will resume in a phased manner. The hotel and travel industry in India is very mature. It will come up with innovative offerings. From our side we will focus our promotions and campaigns to push those offerings.”

Customers in general still do not feel comfortable to dine in at a sit-down restaurant, travel to a destination and stay at a hotel, points out Rajesh Radhakrishnan, Director of sales and marketing Radisson Blu Resort Goa Cavelossim Beach. “Since the breakeven point in the hospitality industry is relatively high due to high operating costs, the survival of many hospitality businesses heavily depends on increasing the demand for their services and products. Thus, figuring out what will make our customers return is essential and this requires intensive research efforts.”

LOCKDOWN & ITS IMPACT

Hospitality is amongst the sectors that have been hit hardest by this crisis, points out Rajesh Namby, General Manager, The Lodhi, one of Delhi’s premier luxury hotels. “Travel was the first to be completely shut down as countries sealed international borders and flights were suspended, compounded by the nationwide lockdown and restrictions. These circumstances have posed significant challenges for the hotel industry, causing enormous impact. Almost five months of this financial year have been completely wiped off. Inbound tourism has come to a standstill and corporate travel has dropped drastically. Essentially, hotels are now operating with only one segment, which is domestic leisure.”

The extent of impact on the sector due to shutdowns is quite deep, points out Sumit Kumar – General Manager, Hyatt Pune Kalyani Nagar. “In the wake of travel coming to a standstill and the customer showing no urgency to travel, both the occupancies and revenue are grounded.”

Travelpreneurs, especially for small tour operators or local sightseeing agencies, who comprise more than 80 per cent of the travel business, Covid-19 came as a first ever real business disaster impacting 90 per cent of revenue loss though in off-season (April to September), stresses Nilesh Narayan, Founder and Tour Manager at Holy Waters India Journeys. As he points out, ‘socially-distanced walking tours and heritage walks’ have replaced tours by cars or buses. How practical that is when a tourist wants a city tour is anyone’s guess.

Of course, for India’s mountainous areas – unlike the rest of the country, summer is peak season. “Massive cancellations in March lead up to the lockdown and closure of all our hotels has witnessed complete erosion in revenues,” rues Vibhas Prasad, Director, Leisure Hotels Group, which operates a string of hotels largely in Uttarakhand.

What was unthinkable till just a few months ago – getting meals from famed hotel restaurants at home – has become a reality. A notable partnership was when ITC called on Swiggy, and later Zomato. “We are re-engineering our guest experiences with zero/low associate engagement (including digital ordering and e-payment solutions),” according to a statement from Anil Chadha, COO, ITC Hotels. “The partnership with Swiggy will assist us in responsibly delivering our unique culinary experiences using their advanced distribution network.”

What was unthinkable till just a few months ago – getting meals from famed hotel restaurants at home – has become a reality. A notable partnership was when ITC called on Swiggy, and later Zomato. “We are re-engineering our guest experiences with zero/low associate engagement (including digital ordering and e-payment solutions),” according to a statement from Anil Chadha, COO, ITC Hotels. “The partnership with Swiggy will assist us in responsibly delivering our unique culinary experiences using their advanced distribution network.”

Other services were not ignored either. ITC also launched , which allows customers to hand over laundry items at a designated point at the hotel. The laundry is ready for pick up by the customer within 24 hours, who is intimated via a message, which includes a payment link to enable contactless payment. Contact light at every point!

HOW THE INDUSTRY COPED

Cleanliness is clearly the word of the year for the hospitality sector as it seeks to assure customers that their premises and services are safe.

ITC Hotels launched its ‘WeAssure’ initiative, by which it took an accreditation by National Accreditation Board for Hospitals & Healthcare Providers (NABH) – the leading standards organisation for sanitation, hygiene, safety and infection control practices. ‘WeAssure’ is a unique programme designed in collaboration with medical professionals and disinfection experts to further enhance the existing hygiene & cleaning protocols. The stringent program specifications reassure guests of visibly stringent cleanliness and disinfection processes which benchmark clinically hygienic standards, offering guests’ unparalleled comfort with peace of mind,” states Nakul Anand. It has also partnered with DNV GL Business Assurance, one of the world’s leading certification bodies, to ensure stringent clinical levels of hygiene and safety.

ITC Hotels launched its ‘WeAssure’ initiative, by which it took an accreditation by National Accreditation Board for Hospitals & Healthcare Providers (NABH) – the leading standards organisation for sanitation, hygiene, safety and infection control practices. ‘WeAssure’ is a unique programme designed in collaboration with medical professionals and disinfection experts to further enhance the existing hygiene & cleaning protocols. The stringent program specifications reassure guests of visibly stringent cleanliness and disinfection processes which benchmark clinically hygienic standards, offering guests’ unparalleled comfort with peace of mind,” states Nakul Anand. It has also partnered with DNV GL Business Assurance, one of the world’s leading certification bodies, to ensure stringent clinical levels of hygiene and safety.

We have implemented enhanced cleanliness and hygiene procedures and are working towards accreditation from the Global Biorisk Advisory Council (GBAC), a division of ISSA – The Worldwide Cleaning Industry Association, to protect our guests and associates from infectious diseases, says Shobhit Sawhney, General Manager, Hyatt Regency Pune & Residences. “From mandatory temperature checks for all guests, colleagues and vendors to physical distancing signage across all guest areas, along with signage in elevators ensure guests feel safe, checking Aarogya Setu app status for all personnel entering the hotel, our enhanced cleaning process ensures frequent sanitization of high touch areas. Guest rooms have a resting period, before the same is thoroughly sanitized and allocated to another guest.”

We have implemented enhanced cleanliness and hygiene procedures and are working towards accreditation from the Global Biorisk Advisory Council (GBAC), a division of ISSA – The Worldwide Cleaning Industry Association, to protect our guests and associates from infectious diseases, says Shobhit Sawhney, General Manager, Hyatt Regency Pune & Residences. “From mandatory temperature checks for all guests, colleagues and vendors to physical distancing signage across all guest areas, along with signage in elevators ensure guests feel safe, checking Aarogya Setu app status for all personnel entering the hotel, our enhanced cleaning process ensures frequent sanitization of high touch areas. Guest rooms have a resting period, before the same is thoroughly sanitized and allocated to another guest.”

Ashwani Nayar, General Manager, Crowne Plaza Greater Noida points to the enhanced cleaning procedures implemented at the hotel. “The hotel utilizes IHG’s established Way of Clean program which includes deep cleaning with hospital-grade disinfectants in guest rooms and public spaces. The hotel is also providing individual guest amenity cleaning kits; visible sanitizer stations in public spaces; removal of high touch items from guest rooms; replacing in-room collateral with digital communication as well as digitizing dining menus and payments. Ensuring that all incoming vehicles, luggage and supplies are thoroughly sanitised, and that guests as well as our colleagues follow all safety and hygiene processes.”

Ashwani Nayar, General Manager, Crowne Plaza Greater Noida points to the enhanced cleaning procedures implemented at the hotel. “The hotel utilizes IHG’s established Way of Clean program which includes deep cleaning with hospital-grade disinfectants in guest rooms and public spaces. The hotel is also providing individual guest amenity cleaning kits; visible sanitizer stations in public spaces; removal of high touch items from guest rooms; replacing in-room collateral with digital communication as well as digitizing dining menus and payments. Ensuring that all incoming vehicles, luggage and supplies are thoroughly sanitised, and that guests as well as our colleagues follow all safety and hygiene processes.”

Indeed, a number of hotels are now GBAC accredited, but whether that will suffice to entice the customer back will soon be tested.

Communication was crucial during the lockdown, most felt. “Neemrana Hotels continued to interact with its guests and patrons daily through the lockdown,” stresses Nath. “Social media has played a very important role in maintaining customer confidence. The emphasis on marketing and engaging with guests on all online and offline platforms as well as a flexible approach regarding bookings and date change policies has also positively contributed to the success of the hotels post Covid-19. We have launched an internal hygiene program called ‘Pavitr’ which includes all the aspects of the Ministry of Tourism protocols. The key highlights include a digital contactless check-in, deep cleaning of rooms before each arrival, QR codes and menus for contactless dining, sanitisers that have been specially curated for Neemrana and PPE for both the guests and our team.”

“Apart from ongoing Dial-a-Chef promotion, food delivery and staycation offer, at Crowne Plaza Greater Noida we have also rolled out workcation and daycation stay packages along with themed stay breaks focused around golf and wellness,” says Nayar.

Ravi Rai, Cluster General Manager, Novotel Visakhapatnam Varun Beach, The Bheemili Resort Managed By Accor & Novotel Vijayawada Varun, technology has played a vital role in this pandemic situation. “To utilise technology into the business and implement changes as per the guest’s behaviour, it has become imperative to first engage and interact with the guests. We have started conducting online classes around food and wellness. We have also started promoting wellness at home packages, food deliveries, and take away. The hotel has received tremendous response in these uncertain times through these efforts.”

Ravi Rai, Cluster General Manager, Novotel Visakhapatnam Varun Beach, The Bheemili Resort Managed By Accor & Novotel Vijayawada Varun, technology has played a vital role in this pandemic situation. “To utilise technology into the business and implement changes as per the guest’s behaviour, it has become imperative to first engage and interact with the guests. We have started conducting online classes around food and wellness. We have also started promoting wellness at home packages, food deliveries, and take away. The hotel has received tremendous response in these uncertain times through these efforts.”

Cutting costs has been a priority, especially for top end hotels with high operating costs. “We have re-engineered our cost structures and re-looked at some of the fixed and variable costs,” points out Namby. “We are also proactively working on minimising wastage.” For Prasad, cost cutting has included renegotiating with financial institutions to avail of the moratorium and MSME loan packages to manage cash flows and AMC’s with vendors & partners. Other steps included offering furlough / LWP to a small percentage of employees temporarily, pay cuts of employees, and control on energy consumption, purchasing and sourcing among others. Rai points to measures such as floor wise allocation of rooms, keeping only one restaurant operational, no buffet services and laundry only on alternate days.

Cutting costs has been a priority, especially for top end hotels with high operating costs. “We have re-engineered our cost structures and re-looked at some of the fixed and variable costs,” points out Namby. “We are also proactively working on minimising wastage.” For Prasad, cost cutting has included renegotiating with financial institutions to avail of the moratorium and MSME loan packages to manage cash flows and AMC’s with vendors & partners. Other steps included offering furlough / LWP to a small percentage of employees temporarily, pay cuts of employees, and control on energy consumption, purchasing and sourcing among others. Rai points to measures such as floor wise allocation of rooms, keeping only one restaurant operational, no buffet services and laundry only on alternate days.

“The key learning here for hospitality players is that we must accept change gracefully, realign our strategy and be as ready as possible for consumer and business travel in a post COVID-19 world,” reaffirms Shekhawat. “We haven’t had to take any hard decisions yet. Whatever circumstantial difficulties came our way, we are dealing with them in the best possible way.”

WHAT TO EXPECT THIS SEASON

Necessity it seems will continue to be the mother of inventiveness for the sector this year as most operators turn their business models on their heads. Some green shoots are already visible.

“Since July there has been a steady increase in occupancy and the hotels in Rajasthan,” points out Nath. “We expect occupancy levels at all the hotels in north India to return to pre-Covid levels by the third quarter of the current fiscal. The hotels in the South including The Bungalow on the Beach in Tranquebar and Wallwood Garden in Coonoor, both in Tamil Nadu and The Tower House (Kochi, Kerala), will take slightly longer to return to healthy occupancy and revenue levels as the restrictions have been eased as recently as early September 2020.”

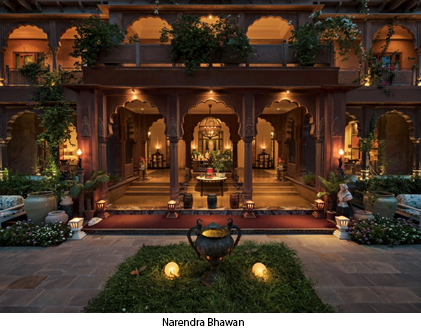

“Given new circumstantial realities, the “hows” may change, but if at all, we believe people will travel more than ever before,” says Shekhawat. “Boutique hotels stand to benefit in a post-COVID world, compared to large chain hotels with a large inventory of rooms and multiple shared communal spaces built to encourage large gatherings. Consumers will re-enter the travel market with caution and social distancing still top-of-mind. As a consequence, people seek to temporarily move their work bases or go for long staycations to destinations that have vast landscapes, scattered scarce population and negligible impact from COVID-19. And to them, a sanctuary in the deserts of Jaisalmer, a haveli in Bikaner (MRS Hotels runs the acclaimed Suryagarh and Narendra Bhawan in Jaisalmer and Bikaner respectively), offer rest and refuge. Hence, we are confident that we will see a positive difference in occupancy during the October 2020 – March 2021 period.”

“Given new circumstantial realities, the “hows” may change, but if at all, we believe people will travel more than ever before,” says Shekhawat. “Boutique hotels stand to benefit in a post-COVID world, compared to large chain hotels with a large inventory of rooms and multiple shared communal spaces built to encourage large gatherings. Consumers will re-enter the travel market with caution and social distancing still top-of-mind. As a consequence, people seek to temporarily move their work bases or go for long staycations to destinations that have vast landscapes, scattered scarce population and negligible impact from COVID-19. And to them, a sanctuary in the deserts of Jaisalmer, a haveli in Bikaner (MRS Hotels runs the acclaimed Suryagarh and Narendra Bhawan in Jaisalmer and Bikaner respectively), offer rest and refuge. Hence, we are confident that we will see a positive difference in occupancy during the October 2020 – March 2021 period.”

Travelling has been largely virtual these last six months, and the industry has adapted accordingly. “We are educating travellers through stories,” says Narayan. “Due to a spike in social media usage during Covid-19, we have increased our presence on digital or social media channels to directly connect with the potential tourist and agents for future purposes.” He also points to a shift from mass tourism to niche segments such as staycations, ecotourism, tribal tourism, adventure tourism and safaris.

Staycations might just be the answer to make up some of the shortfall as many hotels, especially big city business ones, adapt to offer vacations and even work stations. “We will continue to focus on weekend staycation segment as we see a rising demand from those looking for an escape within city limits, says Nayar. A sentiment replicated by almost all hotels.

“Millennials are the most eager to get back out and explore the world after the coronavirus ends,” says Radhakrishnan. “They are more fearless and more desire unique experiences right here, right now. They are taking advantage of the crazy low prices, showing no fear of the virus.”

“Drivable hotels and destinations shall dominate the hotel industry for the current fiscal year,” predicts Nath. “The Neemrana non-hotel Hotels are strategically located near Delhi-NCR and major cities and guests have the option to arrive safely in their own cars. We are expecting similar occupancy levels compared to last year at all our hotels in the October-March period based on the USP and location of our properties.”

WHAT’S IT LOOKING LIKE

The overall outlook for the season is challenging at best. “Indians looking to travel abroad for leisure will also be in small minority,” says Prasad. “Business travel will also take time as WFH routines have become the new normal and organisations would ideally not like to expose their workforce to the threat of the virus. Weddings and social events are getting more traction but in smaller groups. However, MICE (Meetings, Incentives, Conference & Exhibitions) segment may take from six months or more to recover.”

The overall outlook for the season is challenging at best. “Indians looking to travel abroad for leisure will also be in small minority,” says Prasad. “Business travel will also take time as WFH routines have become the new normal and organisations would ideally not like to expose their workforce to the threat of the virus. Weddings and social events are getting more traction but in smaller groups. However, MICE (Meetings, Incentives, Conference & Exhibitions) segment may take from six months or more to recover.”

A number of available lead indicators are pointing toward a modest recovery from November 2020 onwards, but the pace of year-on-year contraction is pegged at a very high rate, says Sawhney. “Only when the lockdown is entirely lifted, including containment zones, and the level of infection is negligible, can a year-on-year comparison be justified. Otherwise, looking at year-on-year data would tend to disappoint.”

“It will take a further 6-10 months for RevPAR and ADR to recover,” says Radhakrishnan. “Now more than ever, we have a hotel recovery strategy, and are focused on setting realistic expectations and KPIs.”

Rai is looking forward to a positive turn in sales for the last quarter, while admitting that “we are expecting close to a 30 per cent occupancy difference”.

Nayar’s note of optimism stems from his hotel being a preferred wedding destination. However, as he puts it, “Now, ‘intimate wedding’ will replace the ‘big fat Indian wedding’.” The industry fears that ‘intimate’ may translate to shortfall in revenues.

Prasad says, “We expect revenues to take a beating of 40 per cent or more in this financial year. From an average of 60 per cent plus occupancy group wide, we would be grateful to achieve even half of that this financial year.” He says that in the near future, “we only expect domestic leisure to pick up wherein people would take their own car and travel to areas where there are limited cases or chances for exposure. We don’t expect inbound tourists to come to India for another year or longer.”

“We are expecting an occupancy drop of about 7-10 per cent compared to last year, says Namby. “This is based on the expectation that the inbound segment will not function for now, however we have tried to offset that with more focus on the domestic market.” He is taking the creation of ‘air bubble’ arrangements as an encouraging sign. “International travel between India and more countries could soon be possible as more such bubbles are being created.”

“We are expecting an occupancy drop of about 7-10 per cent compared to last year, says Namby. “This is based on the expectation that the inbound segment will not function for now, however we have tried to offset that with more focus on the domestic market.” He is taking the creation of ‘air bubble’ arrangements as an encouraging sign. “International travel between India and more countries could soon be possible as more such bubbles are being created.”

“Hotel occupancies largely depend on state government guidelines and restrictions, improvement in Covid control by government, travel capacities and guidelines besides customer confidence based on improvement of situation and control of pandemic related situation,” says Kumar.

For Nath though, the signs of recovery are already evident based on the number of incoming calls, emails and conversions that have steadily increased from June till date. “The feedback from guests has been heartening and hotels across the country have acknowledged the fact that they are going to be largely dependent on the domestic market for at least another year.” He cautions though that “there must be a uniform policy so that the hotel industry can function without sudden hiccups like Section 144 being imposed in certain districts or individual SOPs issued regarding marriages, social functions, and inter-state movement of tourists.”

A concern for the sector has been the lack of government aid. “There has been no word about the tourism and the hospitality sector from the Finance Ministry,” industry veteran Subhash Goyal, Chairman of the STIC Travel Group and Chairman, Assocham National Council on Tourism & Hospitality is on record saying. Unlike in countries such as the US, UK, Germany, France, Singapore, Japan and Australia, the sector found no mention in the federal bailout measures.

A concern for the sector has been the lack of government aid. “There has been no word about the tourism and the hospitality sector from the Finance Ministry,” industry veteran Subhash Goyal, Chairman of the STIC Travel Group and Chairman, Assocham National Council on Tourism & Hospitality is on record saying. Unlike in countries such as the US, UK, Germany, France, Singapore, Japan and Australia, the sector found no mention in the federal bailout measures.

“While a typical foreign tourist (10.89 million in 2019) spends much more than a domestic tourist, the sheer volume of domestic tourism would be a major contributor to the Indian economy post Covid-19,” says Narayan. “The Indian tourism economy needs a 50/50 concoction of both the worlds.” He expects an 80-90 per cent revenue loss this season as compared to the previous year.

“Recovery signs for the industry will get reflected in actual usage improvement for hotels, whether it is accommodation, food and beverage usage or other services,” says Kumar. “There will be several factors pertaining to buyer behaviour, which will impact the recovery. While the corporate performance and quarterly economic performance indicators will also capture recovery signs, the actual proof of the pudding will be in the eating.” Indeed.